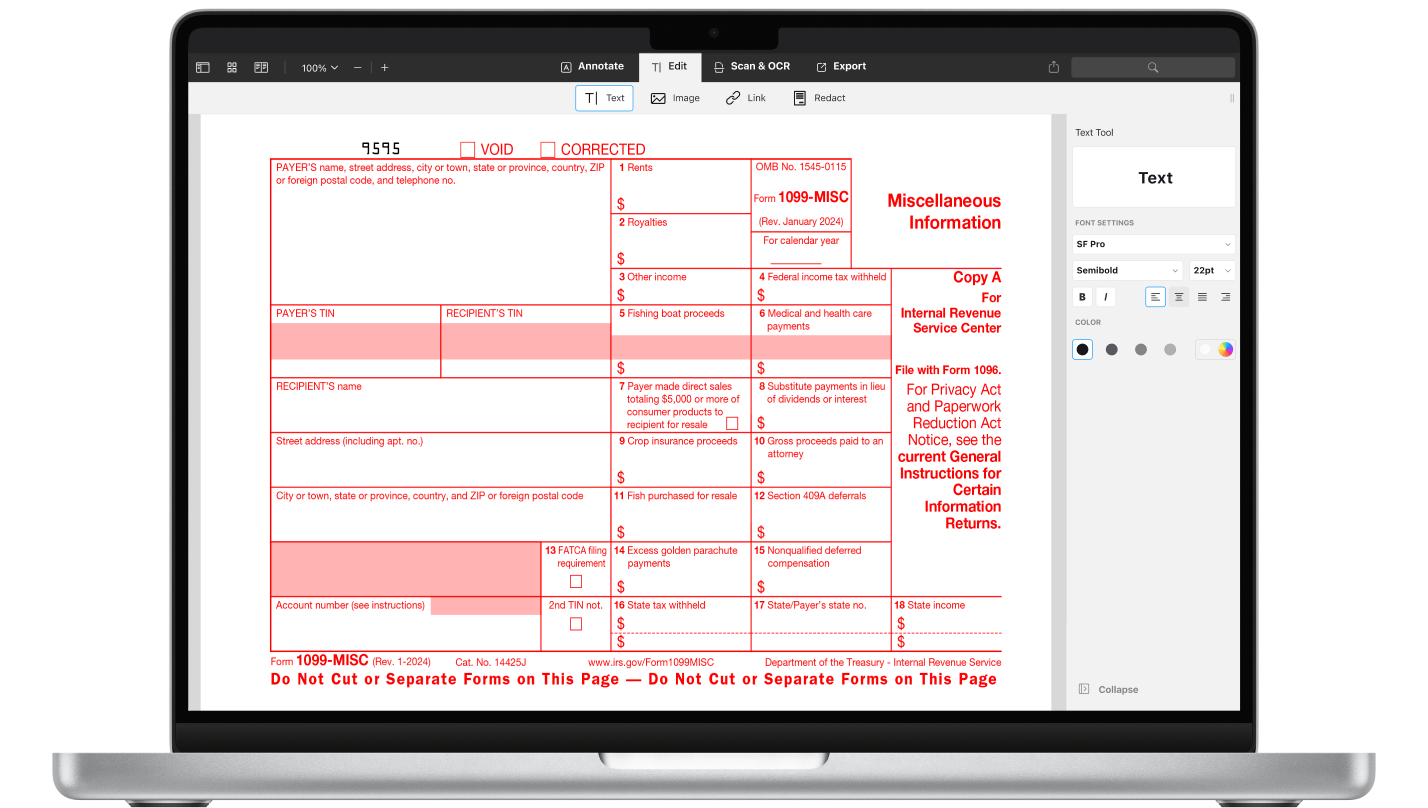

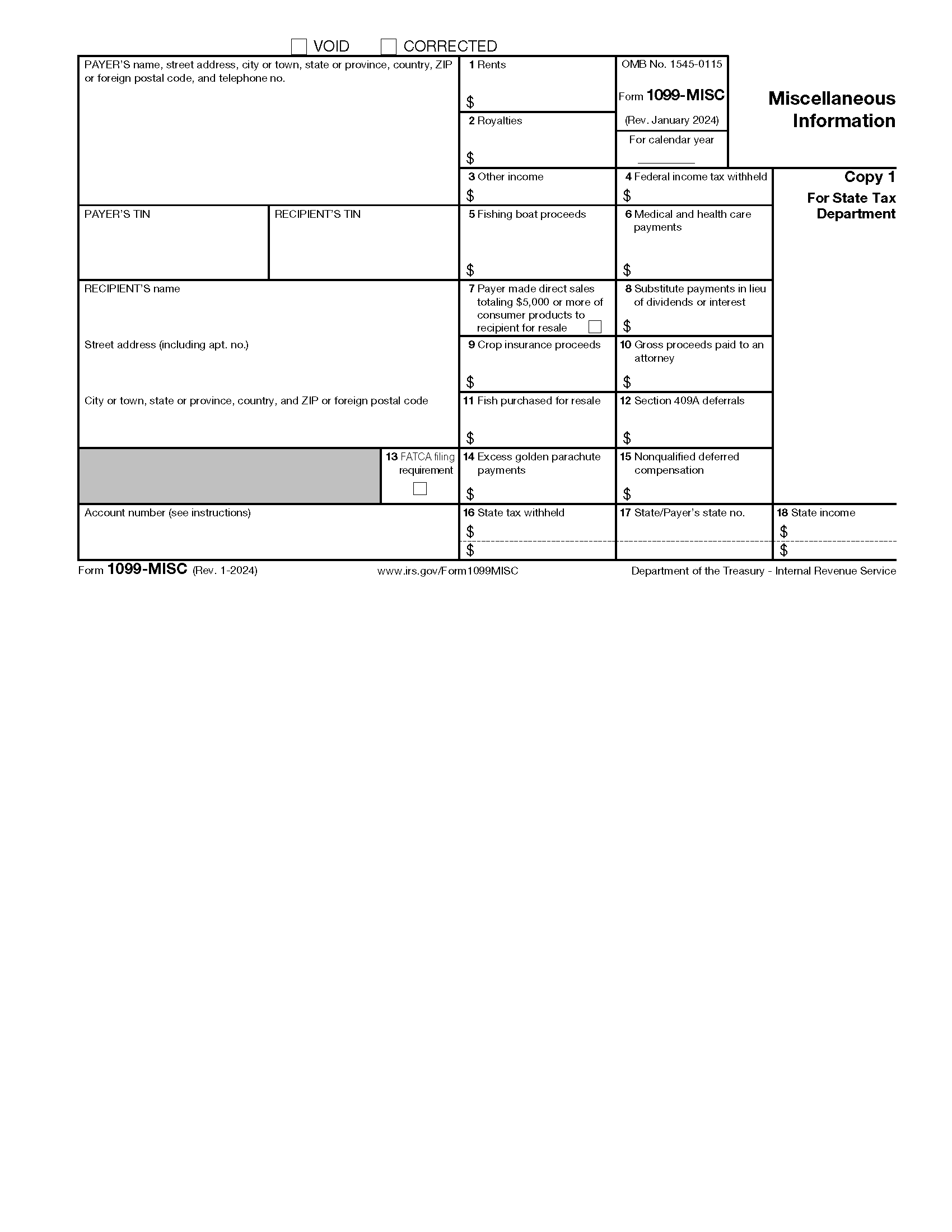

Thinking about tax season can be overwhelming, but having the right tools can make it a little easier. One essential form for self-employed individuals is the 1099-Misc Printable Form.

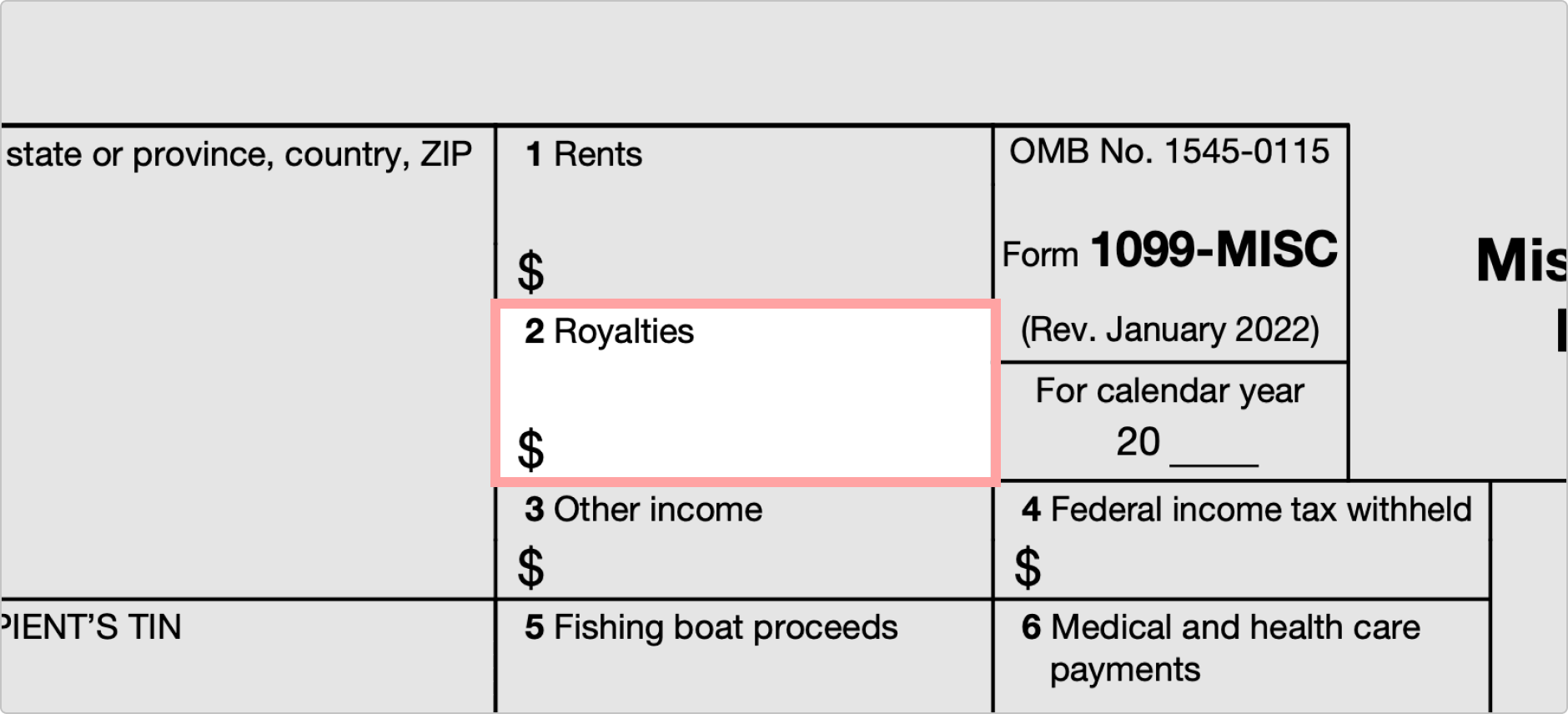

This form is used to report miscellaneous income like freelance earnings, rental income, or prizes. It’s crucial for freelancers, gig workers, and independent contractors to accurately report their income to the IRS.

1099-Misc Printable Form

1099-Misc Printable Form: What You Need to Know

Before you start filling out your 1099-Misc form, make sure you have all the necessary information handy. This includes your Social Security number, income amounts, and any applicable deductions.

When filling out the form, double-check all your entries for accuracy. Any mistakes could lead to delays in processing or even IRS audits. It’s always better to be thorough and precise when reporting your income.

Once you’ve completed your 1099-Misc form, make sure to keep a copy for your records. This will come in handy if you ever need to reference it in the future or if the IRS requests additional information.

Remember, accuracy is key when it comes to tax reporting. By using the 1099-Misc Printable Form and following the guidelines, you can ensure that your income is reported correctly, giving you peace of mind during tax season.

So, don’t stress about tax time – arm yourself with the right tools like the 1099-Misc Printable Form and stay organized. With a little preparation and attention to detail, you can navigate tax season with confidence.

Form 1099 MISC What It Is And What It s Used For

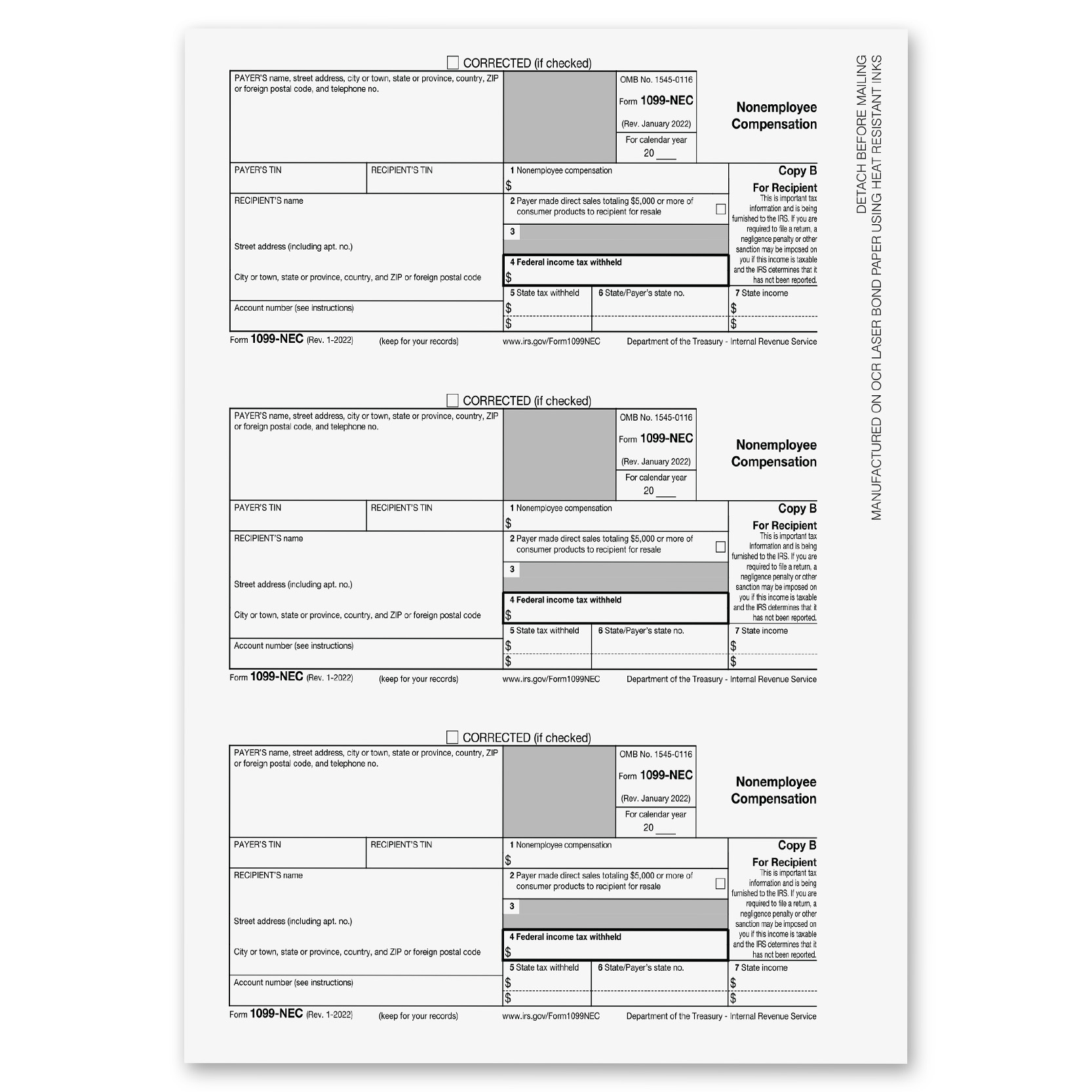

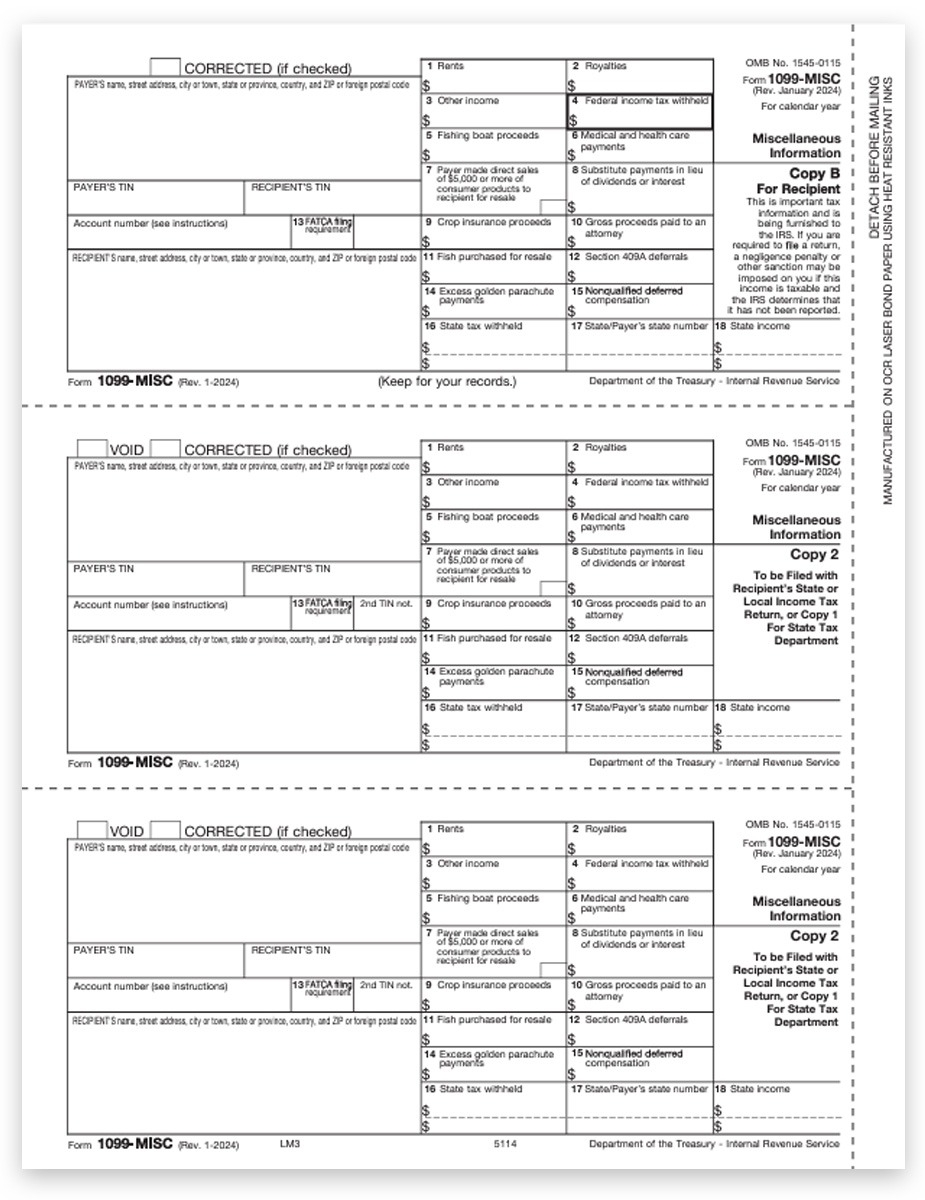

1099MISC Forms 3up For Recipient And Payer DiscountTaxForms

2024 1099 MISC Form Fillable Printable Download 2024 Instructions

Das IRS Formular 1099 MISC F r 2025 Als PDF Ausf llen

Free IRS Form 1099 MISC PDF EForms