Are you looking for a convenient way to file your taxes this year? The 1099 NEC printable form might be just what you need. This form allows you to report non-employee compensation to the IRS easily.

With the 1099 NEC printable form, you can accurately report any payments made to independent contractors or freelancers. This form is essential for businesses that have paid $600 or more to non-employees during the tax year.

1099 Nec Printable Form

Why Choose the 1099 NEC Printable Form?

One of the main benefits of using the 1099 NEC printable form is its simplicity. You can easily fill out the required information, such as the recipient’s name, address, and social security number, without any hassle.

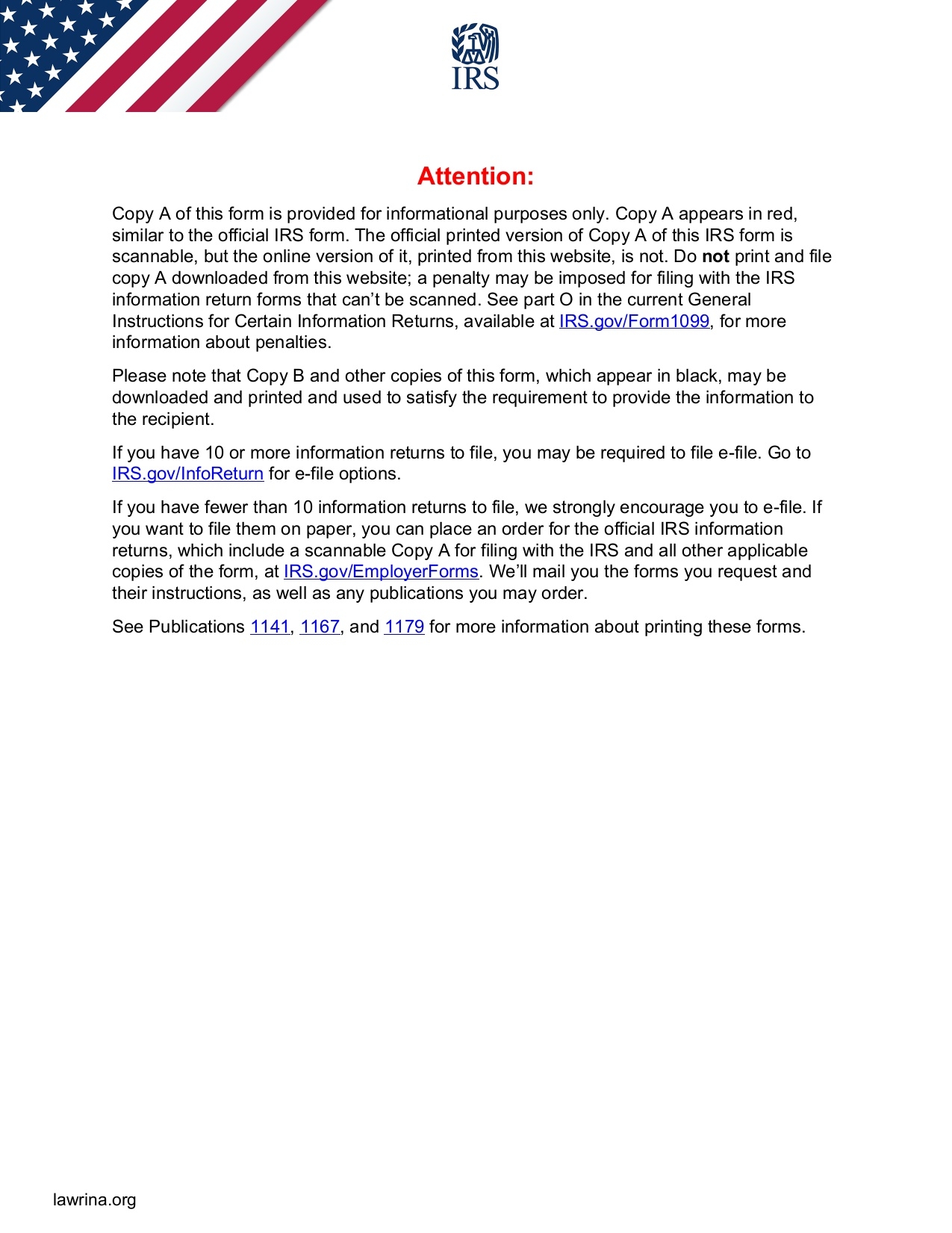

By utilizing this form, you can ensure that you are compliant with IRS regulations and avoid any potential penalties for failing to report non-employee compensation. It’s a straightforward and efficient way to stay on top of your tax obligations.

Whether you’re a small business owner or a self-employed individual, the 1099 NEC printable form can streamline the tax filing process for you. Say goodbye to complicated paperwork and hello to a more straightforward way of reporting non-employee compensation.

In conclusion, the 1099 NEC printable form is a valuable tool for businesses and individuals alike. By using this form, you can accurately report non-employee compensation and avoid any potential IRS issues. Make tax time easier with this convenient form!

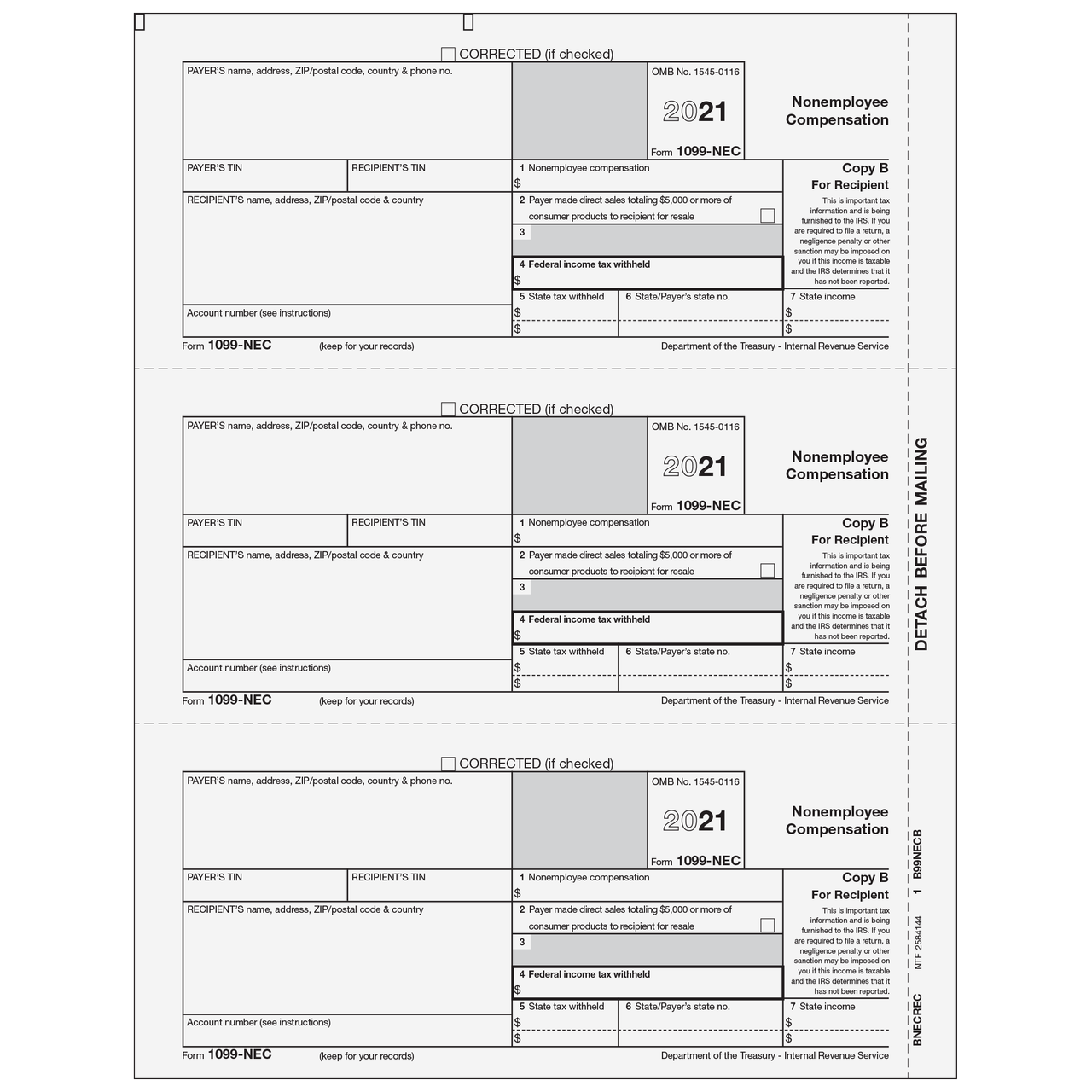

Printable 1099 Nec Form Printable Party Favors

1099 NEC Forms 2023 4 Part Tax Forms Kit 25 Vendor Kit Total 38 108 Forms ONGULS

IRS Form 1099 NEC Template PDF Lawrina

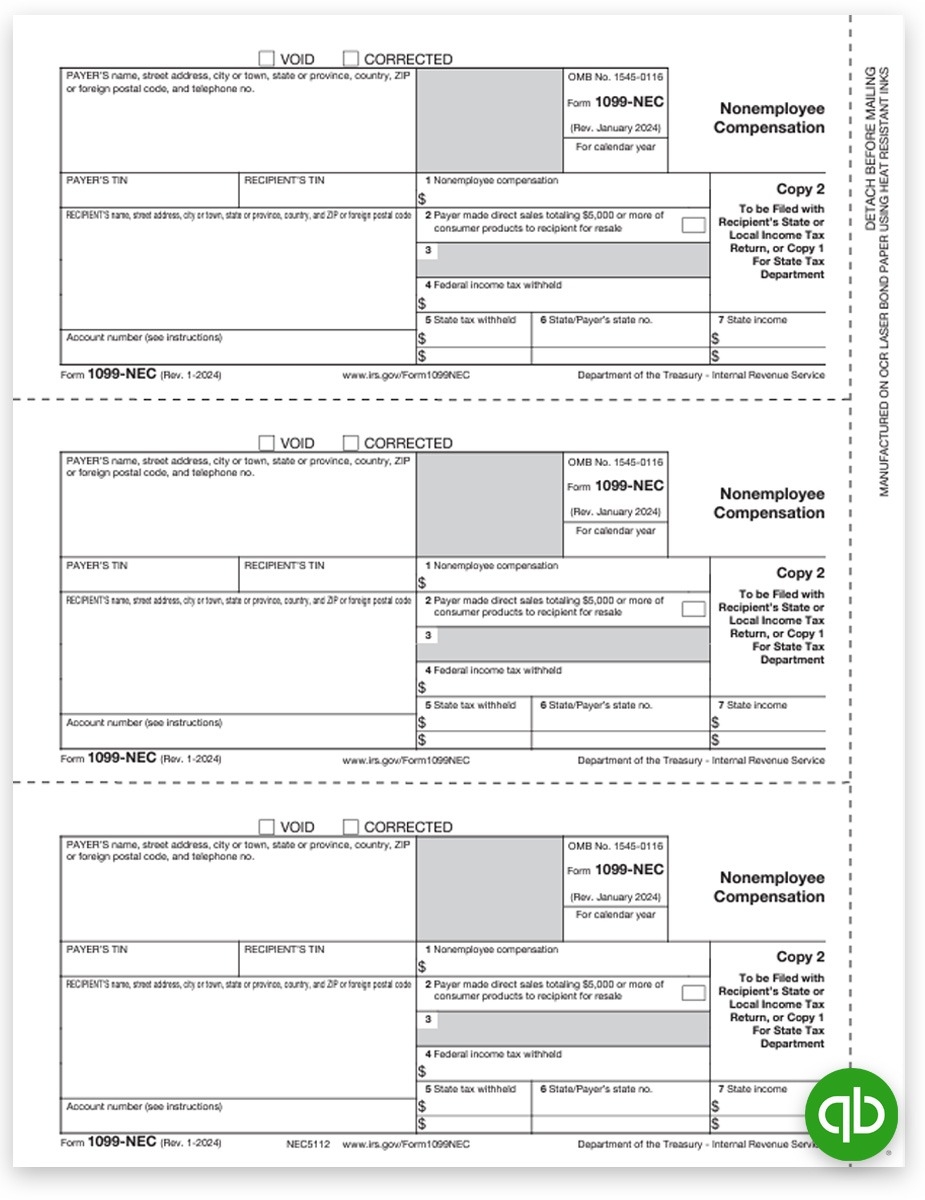

QuickBooks 1099 NEC Forms Envelopes DiscountTaxForms

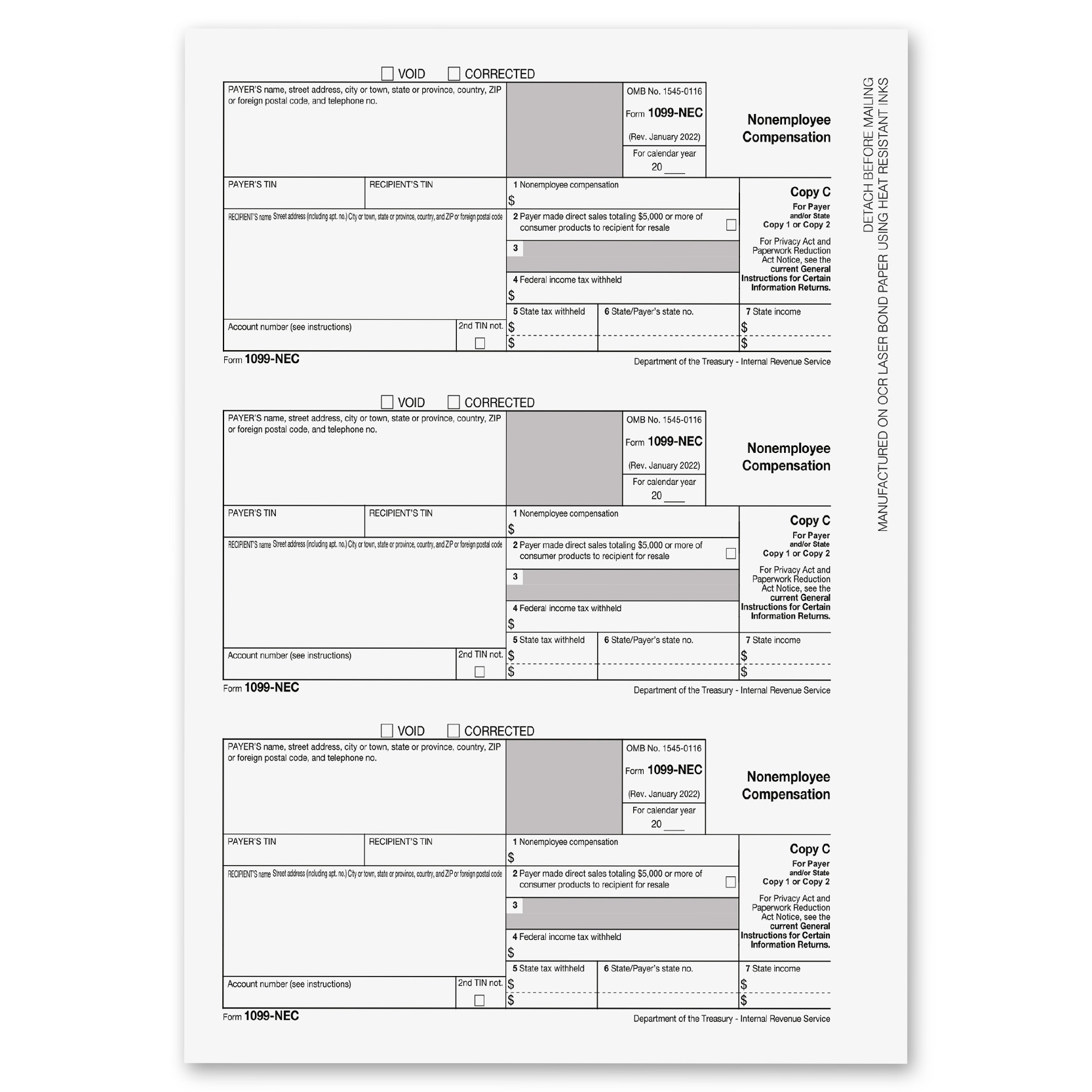

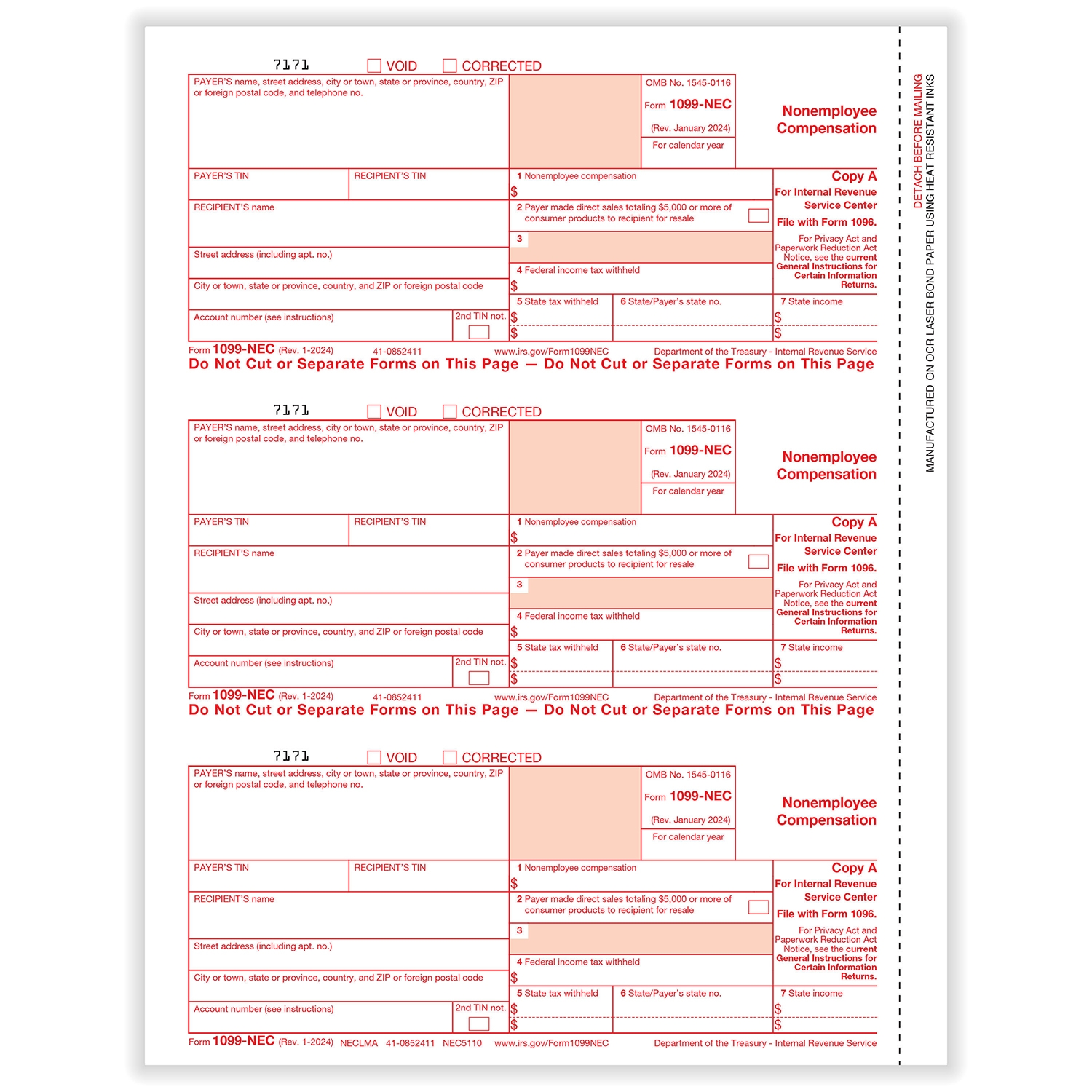

1099 NEC 3 Up Individual Fed Copy A Formstax