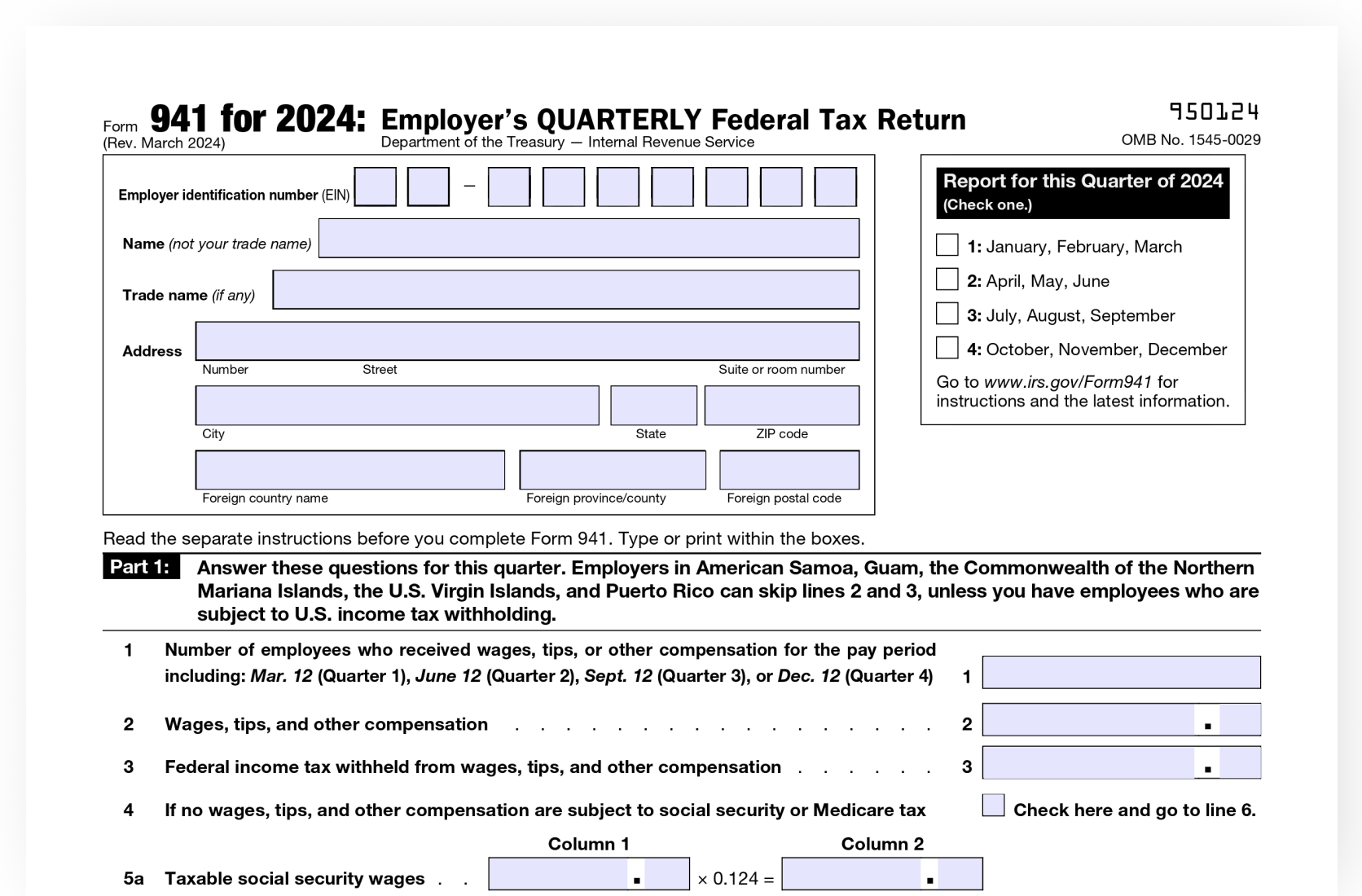

Are you looking for a convenient way to file your taxes in 2025? Look no further! With the 2025 Form 941 printable, you can easily fill out and submit your tax information without any hassle.

Whether you’re a small business owner or self-employed individual, the 2025 Form 941 printable is designed to make the tax-filing process smooth and stress-free. Say goodbye to complicated paperwork and hello to simplicity!

2025 Form 941 Printable

Streamline Your Tax Filing with 2025 Form 941 Printable

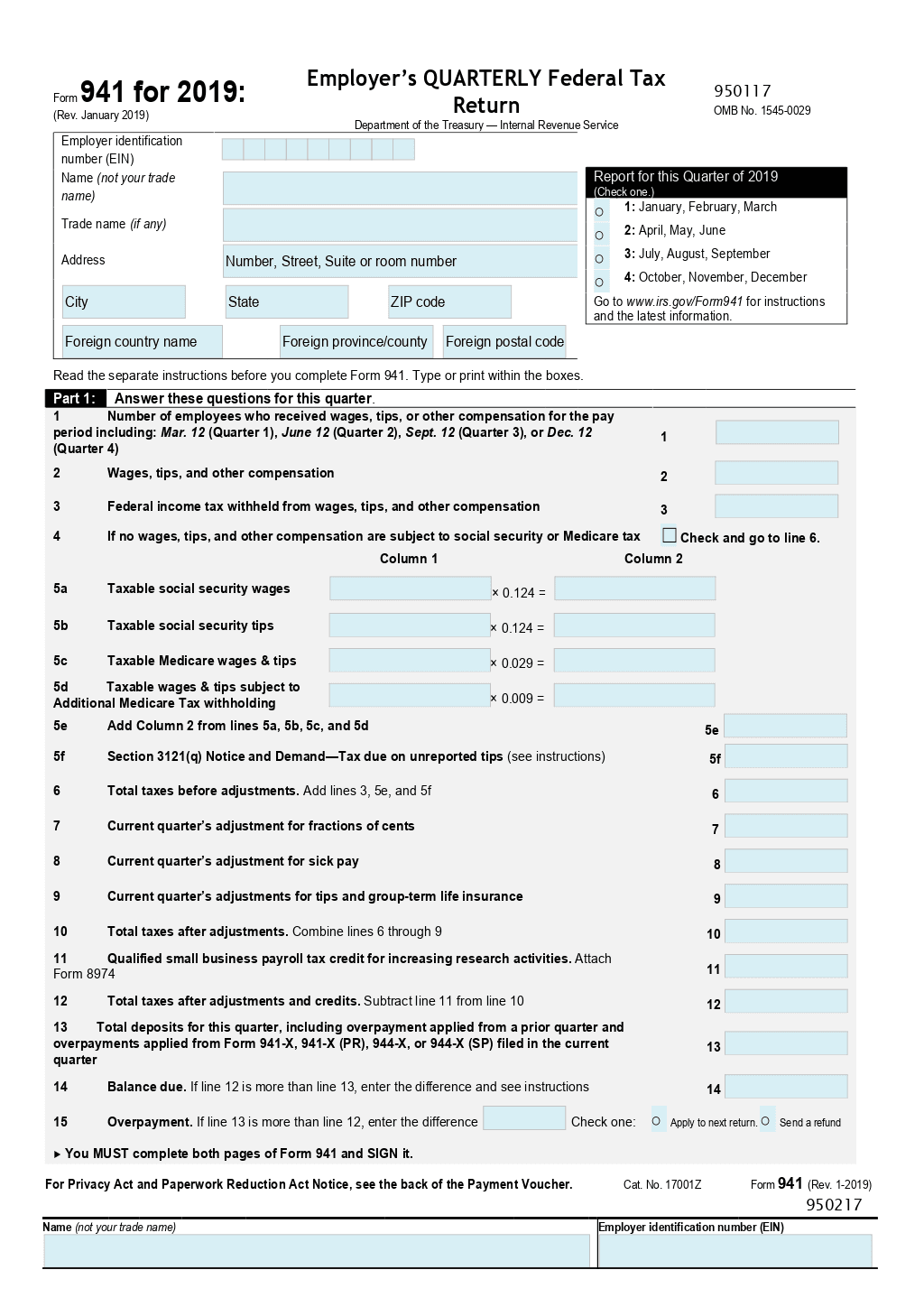

By using the 2025 Form 941 printable, you can quickly and accurately report your wages, tips, and other compensation. This form is essential for employers to report federal income tax withheld from employees’ paychecks.

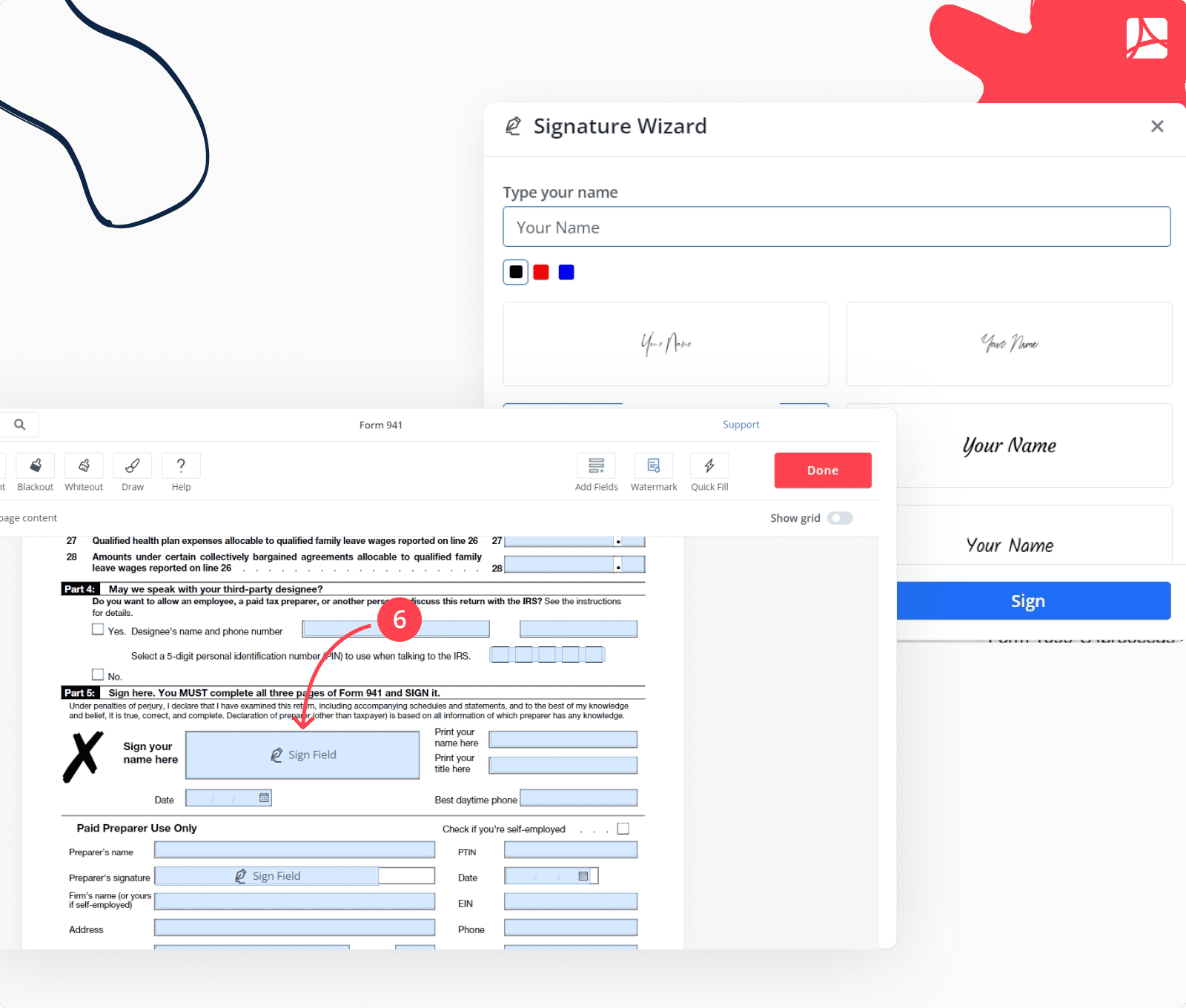

With clear instructions and easy-to-follow guidelines, the 2025 Form 941 printable ensures that you provide all the necessary information to the IRS. Stay organized and compliant with this user-friendly tool.

Don’t let tax season overwhelm you – take advantage of the 2025 Form 941 printable to simplify your filing process. Save time and avoid costly mistakes by utilizing this convenient resource today!

Make tax season a breeze with the 2025 Form 941 printable. Say goodbye to long hours of paperwork and confusion – streamline your tax filing process and focus on what matters most to you. Download your printable form now and take the stress out of tax season!

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

How To Generate And File IRS Quarterly Federal Form 941

Form 941 Fill Out Form 941 Tax 2025

Das IRS Formular 941 F r 2024 2025 Ausf llen PDF Expert